Eaton Gate

Capital Partners

Experience counts!

Eaton Gate works actively with management to define a value creation strategy, implement operational improvements and solve potential or existing issues within the business, as well as to identify organic and acquisition-based growth opportunities

Current projects include impact, tokenisation, community fintech and media / IP companies.

Investments

Investing since 2002, covering technology, media, fintech, alternative energy, retail brands and medical devices

Advisory & Consulting

Advised Sovereign organisations, media, infrastructure, power, luxury companies, Formula One teams as well as interested buyers of Formula One, to support their ambitions on significant large projects

Partners

Focus on the real-money gaming and services industry by a leading team of M&A and Operating leaders

FIntech specialists to support PE and VC investors as well as originate new concepts

Specialist leadership team to exploit the gap between media IP ownership and commercialisation in the new media paradigm

Leading energy transition fund with international profile

Climate tech SaaS

Highlights

of Previous Investments & Engagements

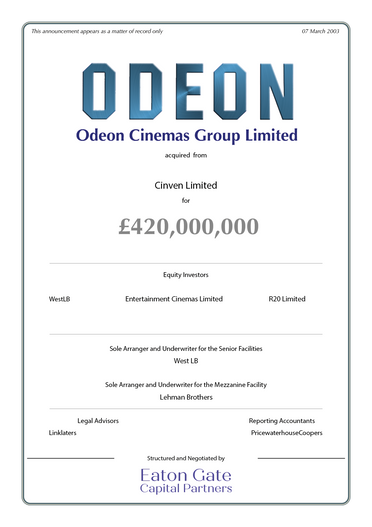

Engagement: Leading Cinema Chain

Investment: Media IP Company

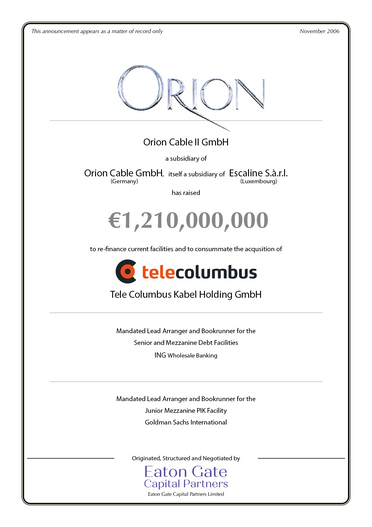

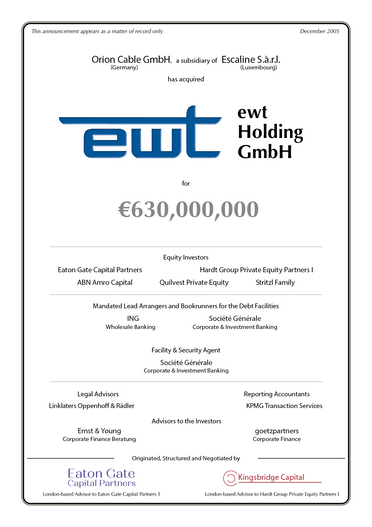

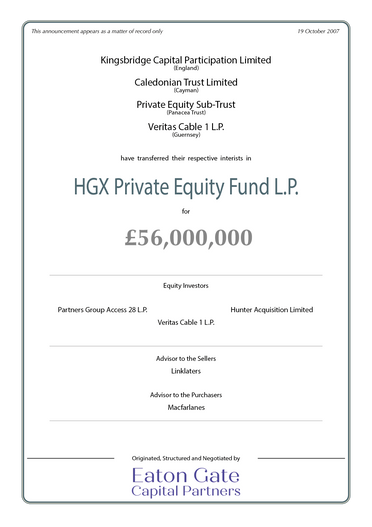

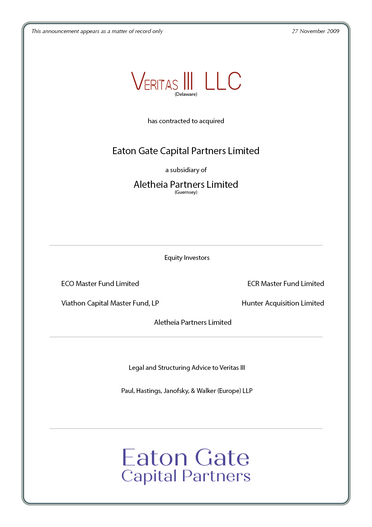

Investment: German Cable TV

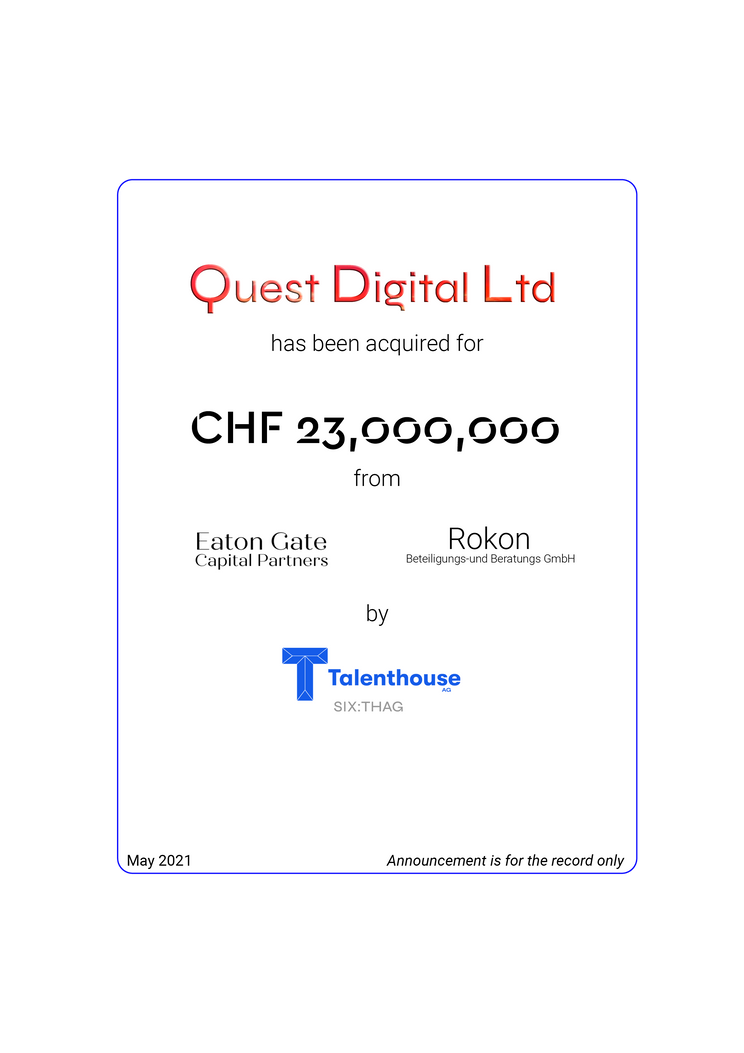

Investment: Creator Tech Platform

Engagement: Iconic Development with Sovereign Fund & Leading Luxury Conglomerate

Engagement: Industrial scale solar power plants

Leadership

2002 - today

2002 - today

Scott and Clare have worked together over the last 20+ years. We are a husband and wife team sharing six children together.

Our partnerships with leading subject matter experts allows us to function across disciplines and deliver the benefits that our experience affords.

Areas of focus

Experience in regulated industries and complicated financings is a core strength, but also the International nature of our assignments means we can bring value where others may struggle with perspective and local challenges.

Creator economy

Metaverse and Gaming

Fintech

Infrastructure & Power

More about us

Scott Lanphere

II am a serial private equity professional, even paying my way through university working for a local venture capital fund which was part of a large regional bank.

I later joined Advent International in Boston and then joined them in Europe to help open the European operation. I spent a decade with this fine firm and invested as lead or co-lead in 10 deals across industrial, media and retail sectors. Returns were 3.4x EUR 346m (58.7% IRR), which I invested on behalf of the firm’s various partnerships.

Deutsche Bank’s asset management private equity unit called Morgan Grenfell Private Equity recruited me near the end of the 1990s. My directly attributed investments for this buyout-oriented fund returned 2.2x on EUR 674m invested (67% IRR).

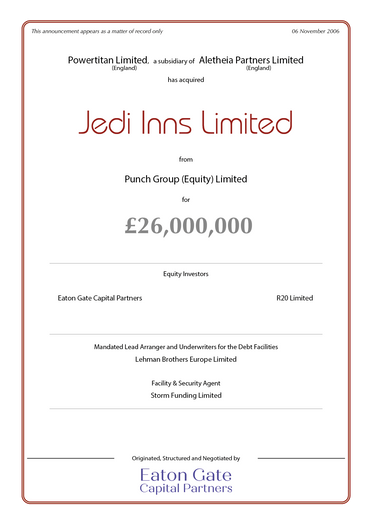

After 9/11, I set out on my own, assembling teams to invest on a deal-by-deal basis (fundless sponsor) as part of Eaton Gate Capital Partners Ltd.. We raised EUR 76m and returned 3.5x for investors on those funds.

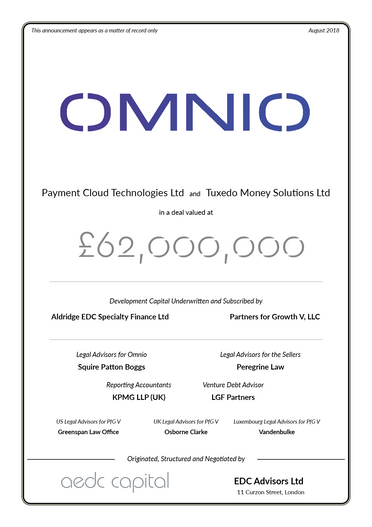

In 2017, while helping restructure a series of investments for a family office, I helped turn around what, in retrospect, was a badly-structured deal and used this as the basis to co-found a new fintech in London called OmniOne. We raised over £35m for this venture and helped arrange a highly lucrative merger that our shareholders declined to embrace; it was time to focus elsewhere. This led to the buy-in opportunity at Talenthouse, a creative media industry deal I restructured and ultimately listed on the Swiss stock exchange as part of a larger consolidation of similar assets in Europe.

Over the past decade, I advised several blue-chip clients on their acquisition and fundraising requirements with assignments over EUR 7.7bn. I supported my deals with over EUR 5bn in debt across the capital structure, including senior equity pieces. I have presided over 5 IPOs and 2 fully-financed tender offers.

I have also been in several executive roles, typically where change management was a factor, and I continue to 'found' business opportunities with my close associates where and whenever possible. My track record is built on teamwork, and future endeavours will be more of the same.

I hold an MBA from Harvard University.

Advent International

Morgan Grenfell Private Equity - Deutsche Bank

Clare McKeeve

I am a seasoned business leader and enjoy integrating and developing teams to create new paths to increase revenue.

Most recently, I served as the CEO and board member of Talenthouse AG, listed on the Swiss SIX exchange. Having taken over management of the business in 2018, I set about building a formidable team to grow organically and through acquisitions, developing a network of leading digital platforms shaping the future of the Creator Economy. After getting Talenthouse on its feet, we had to endure the darkness of the Covid 19 era which was particularly tough on our market segment, but we took the opportunity to innovate faster. We also spearheaded a global call-out to our community to support the UN and the WHO to get contributions for a library of artwork that will educate, uplift, and inspire individuals and communities all across the world through this global crisis. 17,000 submissions came from across the world from more than 150 countries.

For Talenthouse, I led the acquisitions of Ello, Zooppa, Jovoto, Creative Commission and EyeEm, all technology businesses bringing the power of creative communities together with brands. I presided over the closing of the full acquisition of Coolabi in July 2022, including raising their first institutional round of capital with Kartesia. The company also developed and launched a suite of products and services, offering creatives better opportunities to earn and make money through the likes of a new jobsboard as well as more recently in a creator optimised vertical banking offering. We engineered the listing on Six in 2021 before the markets turned sour. At that time, the valuation was north of CHF400 million.

An experienced c-suite and private equity professional, I spent over 24 years in London in Financial Markets, mainly in Private Equity. In 2010, I joined Macquarie Capital, taking on the role of COO for EMEA, and in 2014, she set up a dedicated Consumer Brand Focused Platform to raise capital and assist in the development of high end and premium branded companies.

I am a Fellow Chartered Accountant (FCA) having trained at KPMG in 1998 and hold a Law degree from the University of Glasgow and a Post Graduate degree from Strathclyde Business School in Business, Accounting and Finance. I am a mother to 6 children in their teens and twenties.